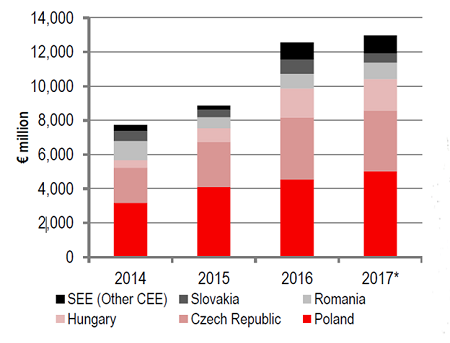

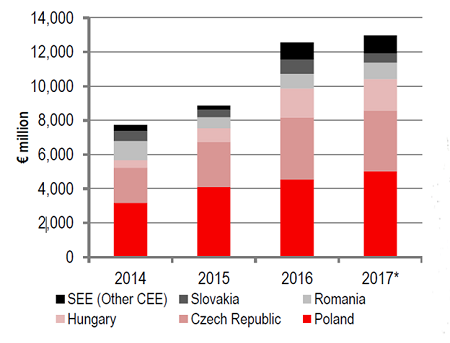

Property investment volume for Romania is estimated at almost €1 billion last year, a value ca.10% higher than the one registered in 2016 (€890 million). Romania accounted 8% of the total investment volume recorded in CEE Region, of €12.98 billion (3.3% increase over 2016). The growth of the Romanian market exceeds the increase of the CEE volumes, but local market is still under its potential.

The full year breakdown saw Poland and the Czech Republic each record new second best ever volumes with a regional share of 39% and 27% respectively. These were followed by Hungary (14%), Romania (8%), SEE markets (8%) and Slovakia (4%), according to CEE Market Report released by JLL.

”The macro-economic forecast for Romania continues to be positive, despite some recent concerns. Sentiment is strong and with a solid pipeline of transactions set for 2018 we expect a good year ahead”, comments Andrei Văcaru, Associate Director, Capital Markets JLL Romania.

In Romania, the number of transactions increased, with the average deal size standing at approximately €28.5 million.

Bucharest accounted for approximately 36% of the total investment volume, less than in 2016, showing that liquidity in secondary cities has improved.

Market volumes were dominated by retail transactions (43%), while industrial, hotels and office accounted for over 22%, 18% and 17% respectively.

A key transaction was the sale of the Radisson Hospitality Complex in Bucharest by Elbit Imaging.

”The Radisson transaction, on the background of a sluggish office investment market, has placed hotels ahead of offices in terms of liquidity in 2017 in Romania, which is unusual.”, commented Andrei Văcaru, Associate Director, Capital Markets JLL Romania, who advised Elbit in the sale of the hotel.

The largest transaction of the year was the acquisition of 50% of Iulius Group’s retail and office portfolio (Iulius Mall Cluj-Napoca, Iulius Mall Iasi, Iulius Mall Timisoara and Iulius Mall Suceava and 3 office buildings) by South African group Atterbury. The second most important retail transaction was the acquisition by Mitiska of a portfolio consisting 11 retail properties and 3 development projects from Alpha Group.

The most notable office transaction was the acquisition by Immochan of Coresi Business Park Brasov from Ascenta Management. Other major transactions include the acquisition of Green Court Building C by Globalworth, from Skanska for €38 million and the sale of ART BC to Hili Properties for €30 million.

In industrial, the largest deal in 2017 was the acquisition of Logicor’s Romanian portfolio as part of a Pan-European transaction by China Investment Corporation form Blackstone. Other major deals included the acquisition of the Renault warehouse in Oarja by Globalworth for €42 million.

CEE Investment Volumes 2014-2017  About JLL

About JLLJLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. A Fortune 500 company, JLL helps real estate owners, occupiers and investors achieve their business ambitions. In 2016, JLL had revenue of $6.8 billion and fee revenue of $5.8 billion and, on behalf of clients, managed 4.4 billion square feet, or 409 million square meters, and completed sales acquisitions and finance transactions of approximately $136 billion. At year-end 2016, JLL had nearly 300 corporate offices, operations in over 80 countries and a global workforce of more than 77,000. As of December 31, 2016, LaSalle Investment Management has $60.1 billion of real estate under asset management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit

www.jll.com.