Important Information

This website uses cookies. By using this website you accept the use of cookies. Learn more.

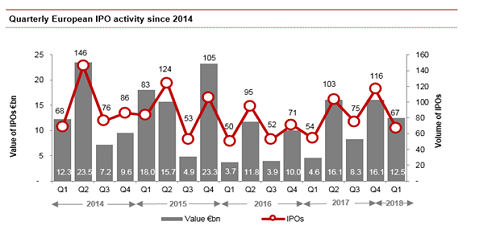

● European IPO markets raise €12.5bn in the first quarter of 2018, 172% increase on Q1 2017

● In the UK 16 IPOs raise £1.3bn compared to £1.8bn from 20 IPOs in Q1 last year

● The two largest IPOs have been on the Deutsche Borse: Siemens’ Healthineers raised €3.7bn and DWS Group raised €1.3bn

The European IPO market has seen a strong start to 2018, with €12.5 bn raised in the first three months of the year, more than double the €4.6bn raised in Q1 2017. This was largely due to the mega-IPOs of Siemens Healthineers and Deutsche Bank’s DWS Group, which raised €3.7bn and €1.3bn respectively, boosting European IPO values towards the end of the quarter.

Deutsche Borse was the top exchange by value, hosting the two largest European IPOs in the quarter with the carve-out IPOs of medical technology company Siemens’ Healthineers and asset manager DWS Group.

The London Stock Exchange remains the number one exchange in Europe by volume, although IPO proceeds are down from last year with 16 IPOs raising £1.3bn compared to £1.8bn from 20 IPOs in Q1 2017. The financial sector continued to dominate UK IPOs and accounted for 71% of proceeds, including JTC plc, the Jersey based institutional and private client financial services business, which raised £244m, UK adviser platform IntegraFin Holdings, which raised £178m and niche lender TruFin, which raised £70m.

Notes to editors.

● IPO Watch Europe surveys all new primary market equity IPOs on Europe’s principal stock markets and market segments (including exchanges in Austria, Belgium, Croatia, Denmark, France, Germany, Greece, the Netherlands, Ireland, Italy, Luxembourg, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland, Turkey and the UK) on a quarterly basis. Movements between markets on the same exchange are excluded.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2018 PwC. All rights reserved.